Reading Time: 3 minutes

Private equity deal activity in North America is pointing towards another down year, while the international market is presenting signs of a rebound and optimistic opportunities. Unsurprisingly, private equity dealmaking has slowed considerably in 2024 as seen in the decline in the number of transactions, higher financing costs, and lower multiples offered to sellers. According to McKinsey & Company’s 2024 Global Private Markets Review, private equity deal volume dropped sharply by 22% from the previous year. Interestingly, this uncertain environment has also created new opportunities for sourcing transactions, such as bringing in attractive international deals.

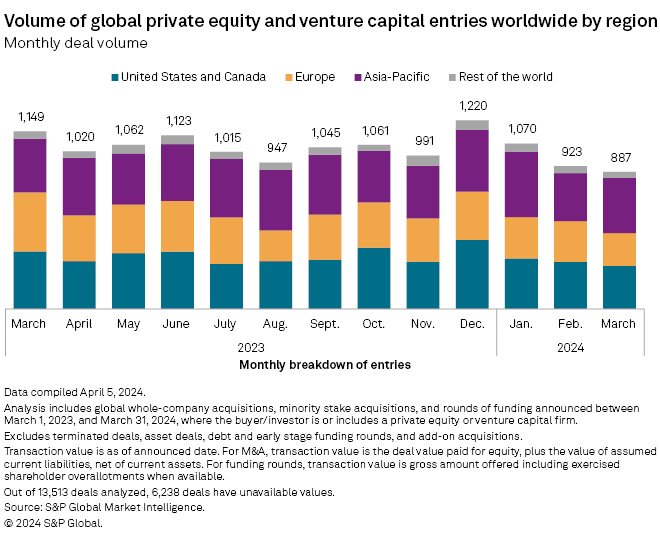

The following chart from S&P Global shows how deal volume in Europe and Asia Pacific, while still in a downtrend, comprises a significant portion of the market over the last six months compared to the North American market.

However, recent months have shown an uptick in deal activity. Examples include lower middle-market deals dominating the US and Canadian markets, with international opportunities presenting an attractive counterbalance to the slower North American market. In the US, a high number of private equity firms combined with low deal volume is creating a more competitive, slower environment. Meanwhile, fundraising challenges are pushing international companies to seek opportunities beyond their borders.

At Tideshift, we are witnessing these market trends firsthand and we wanted to share some key insights with our followers and partners:

- Proprietary acquisitions in the lower middle-market currently make up the majority of deals in the North American market.

- These are usually unbanked and sellers prefer to partner with a platform with significant sales and product development expertise in exchange for retaining minority equity.

- Healthcare, fintech and tech-enabled services with an equal mix of hardware and software components are leading sectors. Although AI is pervasive, only a few companies have fully integrated it.

- Our pipeline consists of a sizeable number of international companies with headquarters in Europe or Asia and subscale US operations. They seek to partner with firms who can support them in expanding revenues in the US with an experienced team.

- Sellers are open to flexible transaction structures with cash at closing combined with sizeable earnout payments for future revenue and EBITDA targets.

We are continuously exploring new investment opportunities and it’s clear that the market is evolving. Despite the slowdown in private equity deal volume, deals are still happening. Looking beyond the usual markets can help mitigate the impact of this slowdown.

About Tideshift

Headquartered in Boston, Tideshift Capital Group is a private investment firm that has been purpose-built to acquire data-rich, growth-focused vertical software and tech-enabled services businesses in the lower-middle market. Our investment focus targets companies generating $7 to $30 million in annual recurring revenue, that are either breakeven or profitable, and have a clear path to 20%+ growth. With a sector-focused approach, the firm targets attractive investment opportunities in North America through buyouts, corporate carve-outs, and majority equity positions in companies in transition. By leveraging the firm’s unique heritage blending investment and operational experience, Tideshift’s distinctive approach propels value creation and is grounded in product-led growth, embedding AI and data and deploying an extensive network of engineering, AI, sales, and marketing resources at scale to create impact velocity. More information is available at www.tideshift.com and on LinkedIn.